Treasury Services

What is it?

Cash Management Basic

Cash Management Plus

- ACH Origination: This feature allows businesses to process payroll (direct deposit), business transfers, and collect payments or dues.

- Online Wires: Tired of coming to the bank to sign a wire form? This feature allows you to process your own wire requests securely online.

- Positive Pay Fraud Prevention: Worried about a fraudulent check hitting your account? Positive pay gives you control of all the checks that clear your business accounts.

What is it?

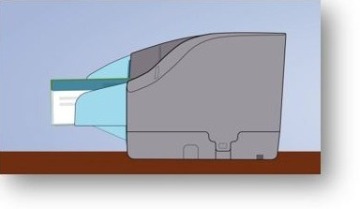

Office Deposit Remote Deposit Capture is a safe, easy and secure way to deposit checks right from your business. There's no more racing to the bank to make deposits. Plus, checks will be in your account sooner, which means better cash flow and more time to run your business.

How it works

Office Deposit comes with a convenient check scanner that plugs into your computer. Don't worry, a bank representative will stop by your business to set it up for you. Use it to scan and deposit checks quickly and easily.

Why it's better

Office Deposit lets you securely process deposits, save time, save fuel, and increase productivity. And with electronic deposits, you stay more organized and won't worry about lost or misplaced checks.

What it means to you

The more you can focus on your business, the more productive you can be. Office Deposit helps save you valuable time by bringing the bank to your business.

*Some features require an application and approval process.

What we offer:

- Credit card processing; electronic check verification; electronic gift, promotional, and loyalty cards; Point Of Sale solutions (payment terminals, software, and internet products); Convenience pay services; Online reporting and support tools

- Processing for all types of businesses: restaurant, retail, internet, medical, dental, lodging, fuel, churches, lawyer offices, salons & spas, lawn & landscape, home-based, and seasonal organizations

- Latest technology for terminals, recurring payments, PC and web-based products, and wireless options

- 24/7 customer support

- Competitive pricing

- On-site set up and staff training

- 100% customer satisfaction policy

- Free consultative visit

- Free analysis for existing merchants